It's Just a Market Correction - Kapiti Market Update

If we had $100 for every time we ares asked, “What’s the market doing?”, We’d be very wealthy indeed. Everyone is keen to know what might be coming next. Do you remember when we used to say, “If I had a penny for every time…”, but with inflation, we really need $100 to cover it! And boy, isn’t that’s a tough one, market prediction, that is! The future has been particularly difficult to predict over the past few years, but here’s a bit of a summary of what’s been happening with the residential property market here in Kapiti.

At First Glance Things May Seem a Bit Grim

Last November, we saw the tail end of a strong and long five to six year “sellers’ market”, which deep down, everyone knew was unsustainable and saw the median sale price peak in Kapiti at $980,000 in October 2021.

Auckland entered a 108-day lockdown that didn’t end till December 2021, which seemed to correlate with a stalling of buyer activity. Not to forget, other influences such as a raising official cash rate and interest rates, raising inflation, 2021 tax and healthy homes legislation for investors, tightening lending criteria and media reporting on global crises have certainly curtailed buyer interest for the last calendar year.

For over a year now, there has been a mood of hesitancy and conservatism amongst most buyers. This has been true across every price bracket, although the top end of the market was a bit slower to dampen, likely due to people with more wealth, being able to absorb the cost-of-living adjustments more comfortably.

But Really, This is Simply a Correction

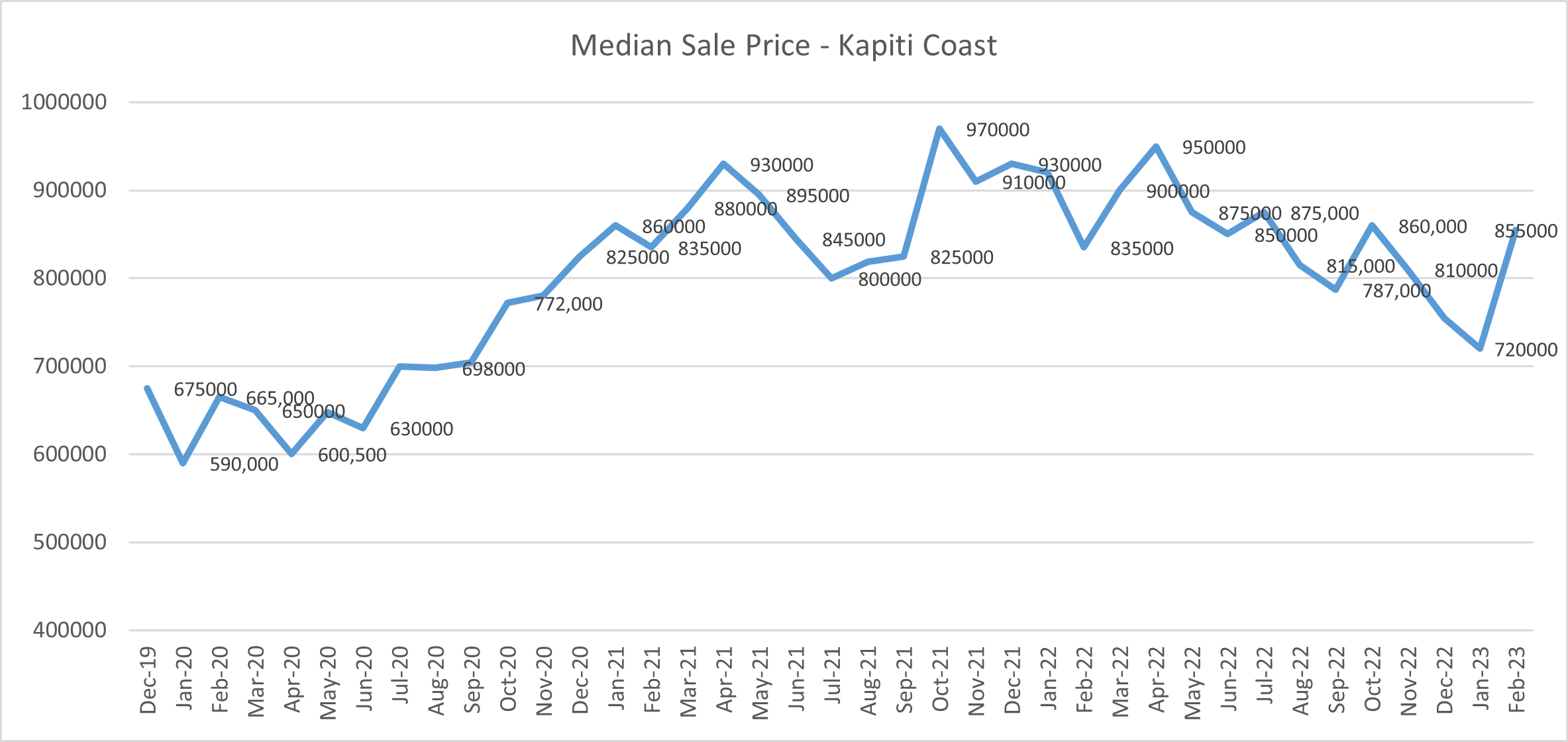

If you cast your eyes over the graph, you’ll see that the decline we’ve seen in property prices pales in comparison to the stark price hike that we saw in Kapiti for the preceding two years.

While the National REINZ House Price Index, which measures the changing value of residential property nationally, has dropped 12.4% from its peak last November it really isn’t a huge correction relative to the gains property has made in value in recent years. In Wellington, the median price was down 17.2% annually, from $1,000,000 to $828,000 in October 2022 and Wellington has recorded five consecutive months of year-on-year median price decreases — the first time since May to September 2011. However, if we were to compare that to the year from October 2020 to October 2021, Wellington recorded a year-on-year increase of 26.8%

Fortunately, as Kapiti is in the privileged geographical position 50km north of Wellington, we are an attractive relocation destination. As seller agents, we are fed a supply of new buyer interest, for every one of our listings, from the Wellington City, Hutt Valley and Porirua. These are people who are looking to improve their lifestyle while getting better value for their Wellington dollars. This does somewhat insulate our region from the extreme price adjustments, some of the larger cities have and will continue to experience. Kapiti has had a more modest reduction of 11.4% in the median sale price year-on-year to October 2022 from $970,000 to $859,000. But for a more macro-perspective, one must really compare this to the previous year, where on average, a gain of 26.1% was made over the same timescale. This, on top of the already banked 20.8% increase in the previous 2019 – 2020 period.

What’s interesting, despite all of the influencing negative variables and ‘fear based media’ that may serve as disincentives to buy, is that homes are still selling, and volumes aren’t much lower. Most people know that when they buy and sell in the same market, the net outcomes are the same for their household. It is our experience, in this market, that most of the people making offers on properties are both selling and buying. We also have first home buyers resurfacing to have a go. Furthermore, folk moving into retirement villages aren’t usually in the position to stall this decision. So really, it’s just those who have recently purchased their first homes and are nervous about having negative equity, and investors who are deterred from participating in this new market.

When we look at the trend in the graph below, and consider we are now into the summer months, which are usually the most buoyant real estate months, we may predict that the sale prices could hold steady for a few months. It may be naive, however, to predict that we are ‘at the bottom’ of the price curve. The Reserve Bank of New Zealand raised its official cash rate in the 9th straight increase in a row, with the biggest hike in history by 75bps, to the highest rate seen since January 2009 of 4.25%.

More official cash rate hikes are predicted to come, and other market influences don’t appear to be softening so we are hunkering down for another year of a tight “buyers’ market”, nevertheless, we don’t for one minute think that buyers will stop buying or the buyer market will dry up altogether. We certainly still have a ‘housing crisis’ in our country where ultimately, demand still outstrips supply. This truth is simply being muffled at the moment, while buyers sit on their hands, or banks get finicky with their lending policy.

The market seems to be different with every property and more than ever sellers just need to make sure they have hired an experienced agent, who has seen times like this before, ensure they have exceptional presentation, a strong marketing campaign and strategic methodology.

This is a time to be agile and responsive, creative, and alert.