Market Update

31st May 2021 - Written by Steph Bradley

Our Village team has been discussing a palpable change to market conditions for about the last for three to four weeks characterised mainly by slightly fewer numbers at some open homes – particularly those that may usually suit first home buyers and investors.

Last week we approached Casey Wilde from TradeMe, to ask her what they are noticing. She stated that “The feedback I’ve had from agencies from Wellington to Hawke’s Bay has been reasonably consistent in the past month seems to be that the market is taking a bit of a ‘pause’ and buyer interest is dropping everywhere. In terms of buyer views, we are starting to see a small drop, but nothing significant, which indicates to me that more buyers are still watching the market but not actively looking.”

Tony Alexander, in an interview with NZHL (New Zealand Home Loans) this week, also acknowledged that there has been a noticeable shift in the market since the government’s March announcements. He commented that the Government is trying to move the market in favour of first home buyers, with the intent of slowing price increases.

Tony suggests this lull in viewings may be quite temporary as investors are taking a “wait and see” approach. He comments it may not be long before investors realise the interest rates are still very low and property is still a good place to have your money. CoreLogic reported that property transactions also show a slight reduction in investor activity – there are fewer valuations being ordered through the banks, but it’s likely a large portion of the drop will be seasonal.

Hesitancy with first home buyers, Tony describes as a “catch 22 situation”. “They have never done this before”, he explained, so when they see other people more experienced stalling to buy, they take their lead.

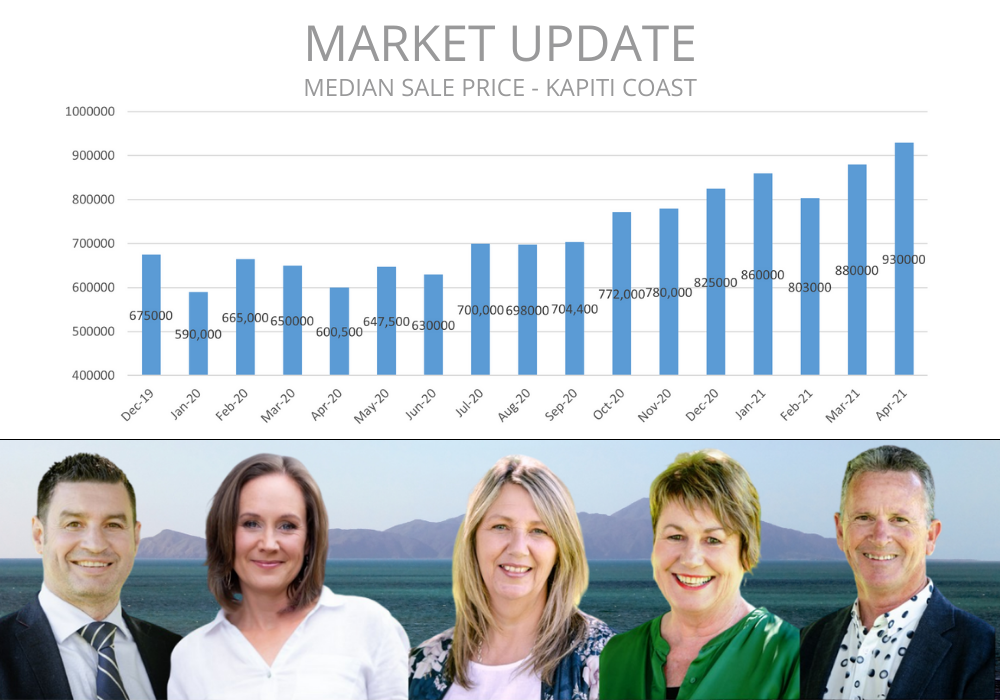

Contrastingly, despite nationwide reported reduced buyer activity, the median sale price for Kapiti in April 2021 hit a new record high of $930,000, indicating that statistically, residential house prices aren’t subsiding and the higher end is still buzzing. We are mindful, however of the three-to-four-week lag in statistical reporting and that each property has it’s own “unique market”. Each sale campaign is different. Nevertheless, anecdotally, and when numbers at open homes are a measure, there still appears to be some indicators of a slowdown, particularly at the lower end.

CoreLogic reported that there are a fewer number of new listings coming to market, but this reduction is seasonally normal.

In summary, it appears the market may be slowing but not declining. We do expect to see a reduced supply in the next few months, as we do in any winter period and alongside that, a reduced rate of value growth. It’s probable, however, that this lull is just a “blip”, a short “buyer sabbatical” in what, we believe, will continue to be a buoyant property market underpinned by a housing supply issue, very good demand and low interest rates. The likelihood of prices dropping is low.

At Village, we are responding by keeping on top of media releases and talking between ourselves about the marketing of our properties and the success of each of our campaign to remain current. We are listening and adjusting to the market. This is a time to be agile and responsive, creative and alert.